Such companies do not mind paying an additional fee to free up cash from these clients’ debts. It is common for companies to have slow-paying freight bills with payment terms of 60 days or more. The freight service is an excellent example of this. Due to their lengthy payment nature, transportation, oil & gas, and healthcare businesses are suitable for invoice factoring.īanks often neglect these industries due to their high risk (think about the volatile commodity market).įactoring can help improve these businesses’ cash flow by financing their slow-paying clients.While the benefits highlighted above apply to most businesses, the index below represents the type of companies where the impact is more salient. The terms are determined based on your business’s account receivables, how much they owe you and how likely they are to pay you.įor this reason, the approval process is usually faster and more hassle-free.Ĭheck out the buyer and seller requirements for invoice financing before applying. They do look at your credit score but not as critically as banks. Since the ownership is transferred to the factoring company, the invoice becomes an off-balance sheet item and is no longer a liability (debt) for the business.įor this reason, invoice factoring is also known as debt factoring, where businesses get rid of debts like unpaid invoices from their balance sheet.įactoring companies are more interested in your buyer’s creditworthiness than your credit score. This procedure allows business owners to run their businesses more efficiently and capitalise on building more robust and longer customer relationships.įactoring does not create additional debt. Invoice factoring unburdens businesses with this time-consuming task because the factoring company is fully liable to collect buyer payments. While large corporates can afford to hire an in-house team for credit control, small business owners don’t have the resources to do so. Late payments are a big reason why businesses often face cash flow problems. One of the inefficiencies that any small business owner has fallen into at least once is debt collection (payment collection). For these reasons, businesses often choose to do discounting over factoring.ĭiscover businesses suitable for invoice discounting with our extensive invoice discounting guide. In conclusion, although invoice discounting offers more flexibility and confidentiality than factoring, the facility is also cheaper.

In both cases, the buyer repays the financed amount to the lender. However, invoice discounting makes the seller liable for payment collection unless the invoice is sold to the lender. In factoring, the seller transfers the invoice and debt collection duties to the intermediary instead, invoice discounting gives the seller an option. Invoice factoring and discounting vary in the flexibility and confidentiality offered to the borrower, but the main difference is the invoice and sales ledger ownership. Seller has control on credit and business finances Lender is disclosed to buyer as ownership transfers Remains with seller unless sold to financierĬhoice to disclose about the financier involvement to debtor Invoice Factoring vs Discounting Invoice Discounting This graph represents a non-recourse factoring process which is the case when the invoice ownership is transferred to the factoring company.

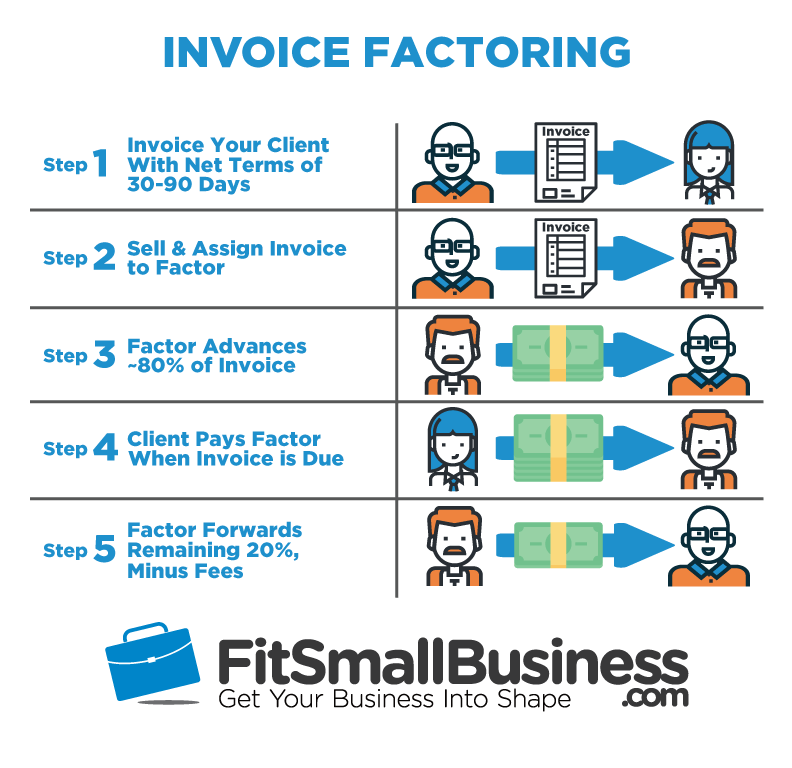

Advances a certain percentage of the invoice, usually 80%.The financier calculates the credit limit (based on the risk profile of the counterparts),.The seller submits the account receivables (invoice) to the factoring company to determine eligibility.There must be a commercial transaction between the buyer and the seller as a prerequisite. Invoice factoring involves three parties – the business in need of financing (seller), the buyer purchasing the goods (debtor), and the factoring company lending money to the business (the intermediary). However, the two facilities differ when it comes to payment collection and invoice ownership.

The process of invoice factoring is very similar to invoice financing process.

0 kommentar(er)

0 kommentar(er)